Scenario: Online Personal Loan request scenario (Accepted)

Submitted by: Domenico Catalano

(Also see the scenario slide deck presented by Domenico at UMA telecon 2009-12-17.)

The Economy downturn and the Financial institution crisis have introduced new needs to increase the control on loan or mortgage request process verifying user credit information and user status, in order to reduce financial risks.

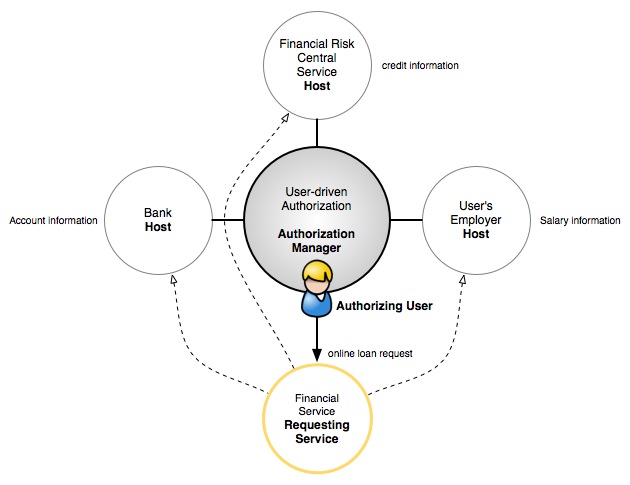

Online Personal loan request is a specific use case in which a user/customer apply a request for a personal loan to a financial service.

To approve or reject the loan request, the financial service must verify many user personal information from different Service Provider/host. For instance, the amount of monthly user salary (i.e. 3 last monthly salary) from user's Employer, user bank account information (account number, net) and need to access to the user credit information (credit history, score, ect.) from the Financial Risk central service.

Today, human interactions are based on online access to Financial Risk Central Service, by Financial service operator, or operator telephone call to user's bank to verify account or to the user's Employer to verify employee status, ect.

Distintive aspects:

- A Consumer (requesting service) that needs a collection of information from multiple sources

- A high-value, privacy-sensitive transaction

- Ensuring that information about the user is third-party verified by using the third parties directly as SPs/Host

Actors:

- User as Authorizing User

- Financial Service as Requesting Service

- User's Employer as Host (salary information)

- User Bank as Host (user account information)

- Financial Risk central service as Host (user credit information)

- Authorization Manager